Starting a business is a dream many people harbor, but turning that dream into reality often requires one crucial element: funding. Startup funding is the lifeline that enables entrepreneurs to transform innovative ideas into operational businesses. Without adequate financial resources, even the most promising ventures can struggle to get off the ground. This article explores the various aspects of startup funding, including sources, stages, challenges, and strategies for success.

Understanding Startup Funding

Startup funding refers to the process of securing capital to start and grow a business. Unlike established businesses, startups often lack steady revenue streams, making it challenging to secure traditional loans. Therefore, entrepreneurs must explore diverse funding options and carefully plan how to utilize the funds effectively.

Funding is not just about money; it also often brings guidance, mentorship, and credibility. Investors, particularly venture capitalists and angel investors, can provide strategic support beyond financial assistance.

Why Startup Funding is Important

Every startup has expenses that must be covered before it becomes profitable. These expenses can include product development, marketing, staffing, operational costs, and technology infrastructure. Proper funding ensures that the startup can:

- Develop and launch products effectively

- Hire skilled personnel

- Scale operations

- Compete in the market

- Survive financial setbacks

Without funding, even innovative ideas can fail to reach the market. Startup funding provides the necessary runway for businesses to grow and achieve their goals.

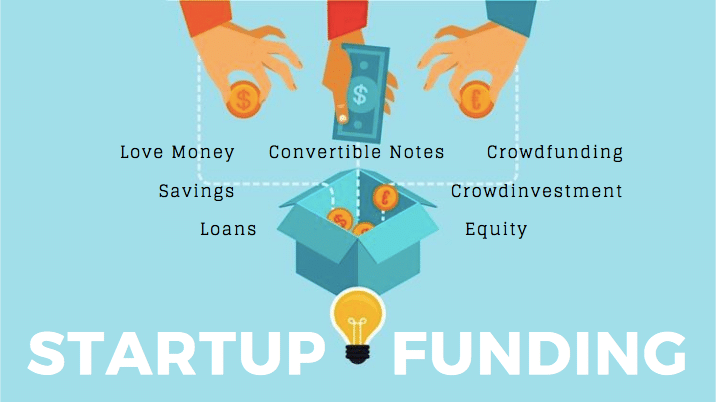

Sources of Startup Funding

Entrepreneurs have several options when it comes to funding their startups. Each source has its own advantages, challenges, and suitability depending on the stage of the business.

1. Bootstrapping

Bootstrapping refers to funding a startup using personal savings or revenue generated from early sales. This method allows entrepreneurs to maintain full ownership and control of their business. However, it also comes with risks, as personal finances are directly tied to the venture’s success.

2. Family and Friends

Some startups begin by seeking financial support from family and friends. This approach can be relatively quick and flexible, but it carries the risk of straining personal relationships if the business fails. Clear agreements and communication are essential in such arrangements.

3. Angel Investors

Angel investors are individuals who invest their personal funds in early-stage startups in exchange for equity. They often provide not only financial support but also mentorship and industry connections. Angel investors typically invest in businesses with high growth potential.

4. Venture Capital

Venture capital (VC) involves investment from professionally managed funds that pool money from multiple investors. VCs usually invest in startups with scalable business models and significant market potential. While venture capital can provide large sums of money, it often comes with stringent conditions and a demand for equity.

5. Crowdfunding

Crowdfunding platforms allow entrepreneurs to raise money from a large number of people, typically via online platforms. This method is particularly useful for products or services that have mass appeal. Crowdfunding can also help validate the idea by gauging public interest before a full-scale launch.

6. Bank Loans and Government Grants

Traditional bank loans and government grants are also options, though they can be difficult for early-stage startups to obtain due to the lack of collateral and proven revenue. Government grants, however, can provide non-dilutive funding, meaning the entrepreneur does not have to give away equity.

Stages of Startup Funding

Startup funding usually progresses through multiple stages, each aligned with the company’s growth and funding requirements. Understanding these stages can help entrepreneurs plan effectively.

1. Seed Stage

The seed stage is the initial phase where the startup requires capital to develop a prototype, conduct market research, and build a founding team. Funding sources at this stage typically include personal savings, family and friends, angel investors, and seed funds.

2. Early Stage

In the early stage, the startup focuses on product development, market entry, and initial customer acquisition. Venture capital and early-stage investment firms often become involved at this point, providing larger sums of funding to support expansion.

3. Growth Stage

During the growth stage, the business has proven its concept and is generating revenue. Funding at this stage is often used to scale operations, enter new markets, and enhance technology. Venture capital, strategic investors, and private equity firms commonly participate at this stage.

4. Late Stage

Late-stage funding supports startups that are already successful but need capital to prepare for an exit strategy, such as an acquisition or initial public offering (IPO). This stage typically involves larger institutional investors and may include mezzanine financing or other structured funding options.

Challenges in Securing Startup Funding

While funding is crucial, acquiring it is often challenging. Some common obstacles include:

- High Competition: Many startups compete for limited investor funds.

- Lack of Track Record: Investors often hesitate to fund startups without a proven business model or revenue history.

- Equity Dilution: Raising capital through investors usually means giving up a portion of ownership.

- Complex Negotiations: Funding deals can involve complicated terms and conditions that require careful evaluation.

- Economic Conditions: Market downturns or economic instability can reduce investor interest.

Overcoming these challenges requires preparation, a compelling pitch, and a clear business strategy.

Tips for Successfully Funding a Startup

Securing startup funding is both an art and a science. Entrepreneurs can increase their chances of success by following these key tips:

- Develop a Solid Business Plan: A clear plan demonstrating potential for growth and profitability attracts investors.

- Build a Strong Team: Investors often invest in people as much as ideas; a skilled and committed team is critical.

- Show Traction: Early customer interest, revenue, or product development milestones can instill investor confidence.

- Network Strategically: Attend startup events, pitch competitions, and industry meetups to connect with potential investors.

- Understand Your Investors: Tailor your pitch to align with the goals, risk tolerance, and expertise of your investors.

- Maintain Financial Discipline: Demonstrating responsible financial management reassures investors about the viability of your startup.

The Future of Startup Funding

The startup funding landscape is constantly evolving. Technology, digital platforms, and global connectivity have made it easier for startups to access capital from diverse sources. Crowdfunding, online angel networks, and specialized venture funds are expanding opportunities for entrepreneurs worldwide.

Additionally, increasing attention on social impact and sustainability has led to the rise of impact investing, where funds are directed toward startups that generate positive social or environmental outcomes alongside financial returns.

Conclusion

Startup funding is an essential component of entrepreneurial success. It enables innovators to bring ideas to life, expand their businesses, and compete in a dynamic market. While securing funding can be challenging, understanding the sources, stages, and strategies involved can significantly improve an entrepreneur’s chances of success.

For aspiring business owners, the journey of startup funding is not just about acquiring money—it is about building relationships, gaining strategic support, and laying a strong foundation for sustainable growth. With the right approach, funding becomes the fuel that propels entrepreneurial dreams into reality.