Effective cash flow management is one of the most critical aspects of running a successful business. Cash flow refers to the movement of money in and out of a business over a given period. While profits indicate a company’s financial health, cash flow is the lifeblood that keeps operations running smoothly. Even profitable businesses can fail if they mismanage their cash flow, making understanding and controlling it essential.

What is Cash Flow?

Cash flow is the net amount of cash being transferred into and out of a business. There are three main types of cash flow:

- Operating Cash Flow: This represents the cash generated from core business activities such as sales, services, and day-to-day operations.

- Investing Cash Flow: Cash flow resulting from investments in assets or securities, including the purchase or sale of equipment, property, or marketable securities.

- Financing Cash Flow: Cash flow related to borrowing, repaying debts, or distributing profits to shareholders.

A healthy business maintains a positive cash flow, meaning more money is coming in than going out. Negative cash flow, on the other hand, can lead to financial stress, even if the company is profitable on paper.

Importance of Cash Flow Management

Managing cash flow is crucial for several reasons:

- Ensures Liquidity: Businesses need cash to pay for daily operations, including salaries, rent, utilities, and supplier payments. Proper cash flow management ensures there is always enough liquidity.

- Avoids Debt Traps: Poor cash flow management often leads businesses to borrow unnecessarily, accumulating high-interest debt that can hurt long-term profitability.

- Supports Growth: Consistent cash flow enables businesses to invest in new opportunities, hire staff, expand facilities, and innovate products or services.

- Improves Financial Planning: Businesses with predictable cash flow can plan better for future expenses and investments, reducing surprises that might disrupt operations.

- Enhances Creditworthiness: Banks and lenders prefer businesses with sound cash flow management, making it easier to obtain financing when necessary.

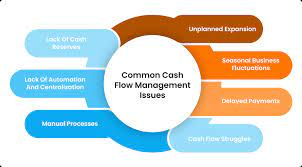

Common Challenges in Cash Flow Management

Despite its importance, managing cash flow can be challenging. Some common obstacles include:

- Late Payments from Customers: When clients delay payments, businesses may face temporary shortages, impacting their ability to pay suppliers and staff.

- High Operating Costs: Unexpected spikes in expenses, such as utility bills, equipment repairs, or supplier price increases, can strain cash flow.

- Poor Forecasting: Without accurate cash flow projections, businesses may misjudge how much money will be available, leading to shortfalls.

- Inventory Mismanagement: Excess inventory ties up cash that could otherwise be used for daily operations. Conversely, insufficient inventory can lead to missed sales opportunities.

- Economic Downturns: Market fluctuations, changing demand, or economic crises can affect revenue streams, making cash flow management even more critical.

Strategies for Effective Cash Flow Management

To maintain healthy cash flow, businesses should adopt proactive strategies:

1. Monitor Cash Flow Regularly

Keeping track of daily, weekly, and monthly cash inflows and outflows is essential. Use accounting software or simple spreadsheets to record and categorize all transactions. Monitoring cash flow closely allows businesses to identify trends, spot potential problems, and make informed decisions.

2. Forecast Cash Flow

Creating cash flow projections helps businesses anticipate future cash needs. Forecasting should account for expected income, upcoming expenses, seasonal variations, and potential delays in payments. A reliable forecast allows managers to plan for shortages or surpluses and take corrective actions in advance.

3. Manage Receivables Efficiently

Implement strategies to encourage timely customer payments, such as:

- Offering discounts for early payments.

- Sending reminders for overdue invoices.

- Clearly defining payment terms in contracts.

Efficient receivable management ensures that the business has access to cash when needed.

4. Control Payables Wisely

While paying bills on time is important, delaying non-essential payments without incurring penalties can help maintain liquidity. Prioritize critical payments such as payroll, taxes, and supplier bills that affect operations.

5. Maintain a Cash Reserve

Building a reserve fund provides a financial buffer for unexpected expenses or temporary revenue shortfalls. This practice helps businesses stay operational even during challenging periods.

6. Optimize Inventory

Maintaining optimal inventory levels reduces cash tied up in unsold products. Implementing inventory management systems and analyzing sales patterns can help strike a balance between having enough stock to meet demand and avoiding excess that drains cash.

7. Reduce Unnecessary Expenses

Regularly reviewing expenses and identifying areas for cost-cutting can improve cash flow. Negotiating better rates with suppliers, reducing energy consumption, or streamlining operations can free up cash for more productive uses.

8. Seek Financing Options

Sometimes, businesses need external funding to manage cash flow effectively. Lines of credit, business loans, or short-term financing can provide temporary relief. However, borrowing should be approached carefully to avoid creating long-term debt problems.

Tools for Cash Flow Management

Several tools can aid in effective cash flow management:

- Accounting Software: Platforms like QuickBooks or Xero track income, expenses, and cash flow trends.

- Cash Flow Forecast Templates: Pre-designed templates allow businesses to project future cash movements.

- Financial Dashboards: Dashboards provide visual insights into cash flow status, helping managers make quick decisions.

- Expense Tracking Apps: Mobile apps help monitor expenditures and maintain budget discipline.

Tips for Improving Cash Flow

Here are practical tips for improving cash flow in any business:

- Invoice promptly and clearly.

- Negotiate favorable payment terms with suppliers.

- Diversify revenue streams to reduce dependency on a single client or market.

- Monitor key performance indicators related to cash flow, such as accounts receivable turnover and days payable outstanding.

- Consider leasing equipment instead of buying outright to preserve cash.

- Encourage repeat business to maintain a steady revenue stream.

- Regularly review pricing strategies to ensure profitability without deterring customers.

Conclusion

Cash flow management is not just about keeping the business afloat—it is a strategic tool that enables growth, stability, and long-term success. Understanding the types of cash flow, monitoring inflows and outflows, forecasting future needs, and implementing effective strategies can make the difference between financial struggle and thriving business operations. By prioritizing cash flow management, businesses can ensure they remain agile, responsive, and resilient in a competitive market.