Running a law firm is both a rewarding and challenging endeavor. Legal professionals often focus on providing top-notch legal services to clients, handling complex cases, and managing their teams. However, one crucial aspect of maintaining and expanding a law firm’s operations often goes overlooked: financing. Law firm loans have emerged as a practical solution to address the financial needs of legal practices, whether they are small boutique firms or larger established agencies. This article explores the concept of law firm loans, their types, benefits, challenges, and how they can impact the growth of legal practices.

Understanding Law Firm Loans

A law firm loan is a specialized financial product designed to provide funding specifically for legal practices. Unlike traditional business loans, law firm loans are tailored to meet the unique financial demands of law firms, which may include operational expenses, office expansion, hiring additional staff, purchasing technology, or managing cash flow during slow periods.

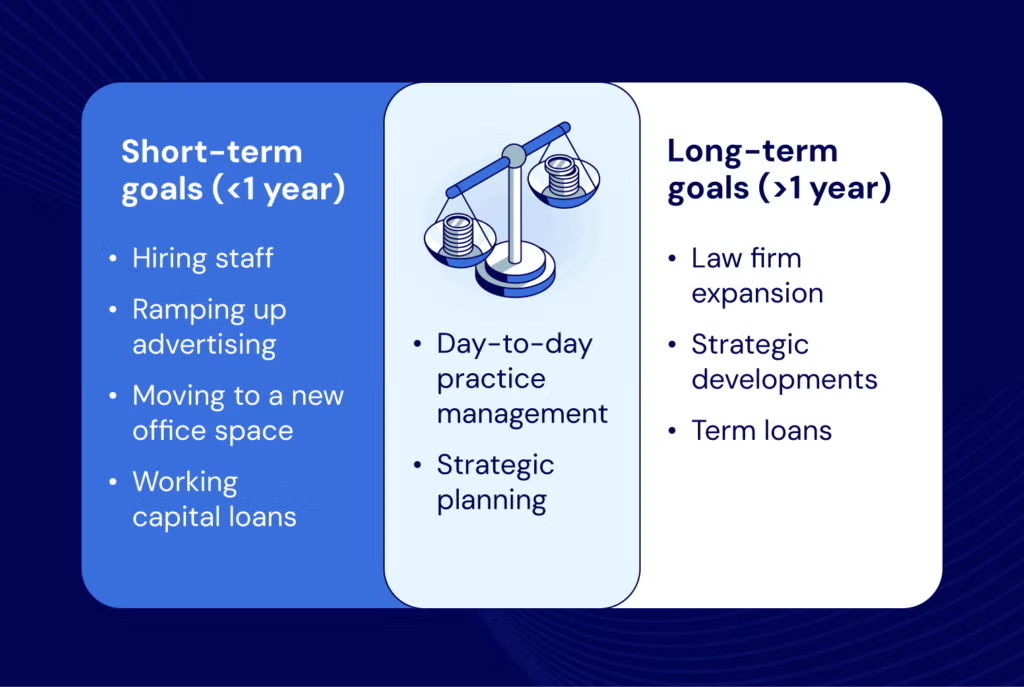

The legal industry operates under unique constraints. Attorneys often face delays in receiving payments from clients due to the nature of legal billing, which can include retainer fees, contingent fees, or long-term litigation cases. These delays can create gaps in cash flow, making it challenging to manage day-to-day operations. Law firm loans help bridge this gap, providing financial stability while allowing lawyers to focus on their core work.

Types of Law Firm Loans

There are several types of loans that law firms can consider depending on their needs and financial situation:

1. Term Loans

Term loans are one of the most common types of financing for law firms. They involve borrowing a fixed amount of money and repaying it over a predetermined period, usually with fixed interest rates. Term loans are ideal for funding larger projects such as office relocation, purchasing equipment, or investing in technology infrastructure.

2. Lines of Credit

A line of credit offers flexibility to law firms by allowing them to borrow up to a certain limit and pay interest only on the amount used. This type of financing is particularly useful for managing cash flow, covering unexpected expenses, or funding short-term projects. Lines of credit provide firms with a safety net, ensuring they can respond quickly to financial needs without the burden of unused debt.

3. Working Capital Loans

Working capital loans are designed to help law firms manage day-to-day operational expenses. These loans are typically short-term and can cover payroll, rent, utility bills, and other recurring costs. By providing immediate access to funds, working capital loans help maintain smooth operations and prevent disruptions in legal services.

4. Equipment Financing

Law firms often require specialized technology, such as legal software, secure data storage systems, or office furniture. Equipment financing allows firms to acquire these essential assets without paying the full amount upfront. Instead, the cost is spread over time, making it easier for firms to manage expenses while upgrading their infrastructure.

5. Invoice Financing

Invoice financing is a unique option tailored to law firms that rely on client billing. In this model, a lender advances a portion of outstanding invoices, providing immediate cash flow. Once clients pay, the firm repays the loan. Invoice financing helps firms maintain liquidity while waiting for client payments, especially in cases with long litigation processes.

Benefits of Law Firm Loans

Law firm loans offer several advantages that can significantly impact the growth and stability of legal practices:

1. Improved Cash Flow

Maintaining consistent cash flow is critical for any business, including law firms. Loans provide immediate access to funds, ensuring that payroll, rent, and operational expenses are met without interruption. Improved cash flow allows attorneys to focus on serving clients rather than worrying about finances.

2. Business Expansion

Law firm loans enable practices to expand their operations by opening new offices, hiring additional attorneys, or investing in marketing and technology. Expansion not only increases the firm’s capacity but also strengthens its competitive position in the legal market.

3. Operational Flexibility

With access to financing, law firms can respond to unexpected expenses or seize new opportunities without depleting their reserves. Loans provide the flexibility needed to adapt to changing market conditions, pursue growth strategies, and maintain business continuity.

4. Building Creditworthiness

Timely repayment of law firm loans can improve a firm’s credit profile, making it easier to secure financing in the future. A strong credit history demonstrates financial responsibility and enhances trust with lenders, vendors, and business partners.

5. Access to Professional Resources

Some law firm loans come with advisory services that help firms optimize their financial strategies. Lenders may provide guidance on budgeting, cash flow management, and investment planning, empowering firms to make informed financial decisions.

Challenges and Considerations

While law firm loans offer numerous benefits, there are certain challenges that legal practices should consider before borrowing:

1. Interest and Fees

Loans come with interest rates and associated fees that can impact the overall cost of borrowing. It is essential for law firms to compare loan options, understand the terms, and choose a solution that aligns with their financial capabilities.

2. Qualification Criteria

Lenders evaluate law firms based on creditworthiness, revenue history, and financial stability. New or small firms may face stricter requirements, making it important to prepare financial documents and demonstrate the ability to repay the loan.

3. Repayment Obligations

Loans create a financial obligation that must be met regardless of business performance. Law firms should assess their cash flow projections and ensure they can meet repayment schedules without compromising operational needs.

4. Impact on Profitability

While loans provide immediate funding, interest payments can reduce profitability. Firms need to weigh the benefits of accessing capital against the long-term cost of debt to make informed decisions.

How to Choose the Right Law Firm Loan

Selecting the right loan requires careful evaluation of a firm’s needs, financial health, and long-term goals. Here are some steps to consider:

- Assess Financial Needs: Determine whether the firm requires short-term working capital, long-term expansion funds, or specialized financing for equipment or technology.

- Compare Loan Options: Evaluate different loan types, interest rates, repayment terms, and flexibility. Understanding the pros and cons of each option ensures the best fit.

- Review Eligibility Requirements: Check credit scores, revenue history, and any collateral requirements to ensure the firm qualifies for the desired loan.

- Calculate Repayment Capacity: Analyze cash flow and forecast expenses to confirm the firm can meet repayment obligations without strain.

- Seek Professional Advice: Consulting financial advisors or accountants can provide valuable insights and help optimize loan selection for the firm’s specific needs.

The Future of Law Firm Financing

The legal industry is evolving rapidly, with increasing reliance on technology, specialized services, and competitive marketing strategies. As a result, the demand for tailored financing solutions is growing. Law firm loans are likely to become more sophisticated, offering flexible terms, lower interest rates, and innovative structures that align with the unique demands of legal practices.

Additionally, alternative financing options, such as fintech solutions and peer-to-peer lending platforms, are providing new avenues for law firms to access capital quickly and efficiently. These developments empower firms to remain agile, competitive, and financially secure in a dynamic legal landscape.

Conclusion

Law firm loans play a pivotal role in supporting the growth and stability of legal practices. They offer a practical solution to cash flow challenges, enable expansion, and provide financial flexibility. By carefully evaluating loan options, understanding repayment obligations, and aligning financing with strategic goals, law firms can leverage loans to enhance operations, invest in technology, and strengthen their market position.

In an industry where client service and operational efficiency are paramount, law firm loans provide the financial foundation needed to thrive. For attorneys and legal professionals seeking to grow their practice without compromising quality or stability, understanding and utilizing law firm loans can be a game-changing decision.